The chart of accounts (COA) is the backbone of any accounting system. It organizes financial transactions into categories, making it easier to track, analyze, and report on a business’s financial health. It is the first step towards creating a well structured accounting system.

What Is a Chart of Accounts?

A chart of accounts is a list of all the accounts a business uses to record its financial transactions. Each account represents a specific type of asset, liability, equity, revenue, or expense. The COA is essential for maintaining organized financial records and generating accurate financial statements.

Structure of a Chart of Accounts

The COA is typically divided into five main categories:

- Assets: Resources owned by the business (e.g., cash, inventory, equipment).

- Liabilities: Obligations owed to others (e.g., loans, accounts payable).

- Equity: The owner’s stake in the business (e.g., retained earnings, capital).

- Revenue: Income earned from business activities (e.g., sales, service income).

- Expenses: Costs incurred to run the business (e.g., rent, utilities, salaries).

Each account is assigned a unique number and name to make identification and tracking easier. Account numbers are often grouped by category, such as:

- 1000–1999: Assets

- 2000–2999: Liabilities

- 3000–3999: Equity

- 4000–4999: Revenue

- 5000–5999: Expenses

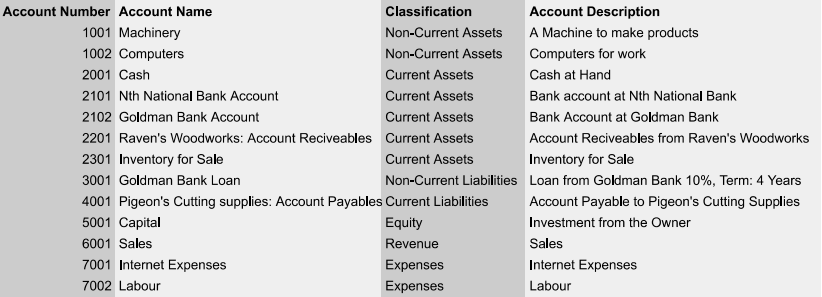

There will be an example at the end to help you better understand this part, containing the accounts used by most businesses.

Steps to Create a Chart of Accounts

1. Understand Your Business Needs

Before creating a COA, analyze your business’s operations to determine the types of accounts you’ll need. For example, a retail store might require accounts for inventory and sales tax, while a service-based business may focus on accounts for labor costs and consulting fees.

2. Define the Account Categories

Start by dividing accounts into the five main categories: assets, liabilities, equity, revenue, and expenses. Ensure each category aligns with your business model.

3. Assign Account Numbers

Assign a unique number to each account based on its category. Use a logical numbering system to keep accounts organized and allow for future additions. For instance:

- 1010: Cash

- 1020: Accounts Receivable

- 2010: Accounts Payable

- 4010: Sales Revenue

In simple words, now any payables Accounts can be numbered from 2010-4009. For Example, a supplier for raw materials could be classified as: 2011:Raven’s Wooden Furnishings.

Now the account numbered 2011 is dedicated to the Raven’s Wooden Furnishings.

4. Create Subcategories

Add subcategories to provide more detail about your transactions. For example, under expenses, you might include:

- 5010: Rent Expense

- 5020: Utilities Expense

- 5030: Office Supplies

5. Set Up the COA in Your Accounting System

Input the COA into your accounting software. Most modern accounting platforms allow you to customize the COA and add, edit, or deactivate accounts as needed.

6. Review and Adjust Regularly

As your business grows or changes, update the COA to reflect new accounts or eliminate unnecessary ones. Regular reviews ensure your COA remains relevant and efficient.

Don’t be afraid to add new accounts in order to make sure everything is well categorized and detailed but also make sure not to overboard and make unnecessary accounts. For example; there is no need to make different accounts for pens, erasers, rulers, staples, etc. when they can all be combined into ‘Office Supplies’.

Tips for an Effective Chart of Accounts

- Keep It Simple: Avoid creating too many accounts. Use broad categories with detailed subcategories only where necessary.

- Be Consistent: Use a uniform naming and numbering system to avoid confusion.

- Plan for Growth: Leave gaps in the numbering system for future accounts.

- Match Financial Statements: Align your COA with the structure of your financial statements to simplify reporting.

Examples of Chart of Accounts

Example 1: Retail Business

- Assets:

- 1010: Cash

- 1020: Accounts Receivable

- 1030: Inventory

- Liabilities:

- 2010: Accounts Payable

- 2020: Sales Tax Payable

- Equity:

- 3010: Owner’s Capital

- Revenue:

- 4010: Sales Revenue

- Expenses:

- 5010: Rent Expense

- 5020: Utilities Expense

Example 2: Service Business

- Assets:

- 1010: Cash

- 1020: Accounts Receivable

- Liabilities:

- 2010: Accounts Payable

- Equity:

- 3010: Retained Earnings

- Revenue:

- 4010: Service Income

- Expenses:

- 5010: Salaries Expense

- 5020: Marketing Expense

Why Is a Chart of Accounts Important?

- Organization: Keeps financial records clear and systematic.

- Accuracy: Reduces errors by categorizing transactions correctly.

- Reporting: Facilitates the preparation of financial statements like the balance sheet and income statement.

- Decision-Making: Helps business owners and managers analyze financial performance and plan effectively.

Conclusion

A well-structured chart of accounts is essential for maintaining accurate financial records and making informed business decisions. By categorizing transactions into organized accounts, you can gain better insights into your business’s performance and ensure compliance with accounting standards.

Leave a Reply